1. The Rise of Bag Inserting Machines: Core Drivers of the Efficiency Revolution

The demand for streamlined packaging processes drives significant advancements in automation. Bag Inserting Machines represent a pivotal innovation, transforming how manufacturers handle products requiring secondary bagging within cartons. This technology addresses critical industry needs for speed, hygiene, and cost control.

1.1 Defining the Equipment and Its Industrial Applications

A Bag Inserting Machine automates the precise placement of inner bags – typically Poly Bags or Plastic Pouches – into open shipping cartons. This operation precedes the insertion of the primary product and the sealing of the carton. The core function involves accurately opening the bag, positioning it within the case, and often securing its mouth open for efficient product loading.

These machines find essential roles across diverse sectors:

Food & Beverage: Safeguarding items like frozen goods, bulk powders (flour, sugar), grains, or hygroscopic products from moisture and contamination. Maintaining product freshness and meeting stringent food safety regulations (e.g., HACCP, FDA) are paramount.

Pharmaceuticals & Nutraceuticals: Ensuring sterility and preventing cross-contamination for powders, capsules, and sensitive ingredients. Compliance with cGMP standards necessitates controlled, human-minimized processes.

Chemicals & Industrial Products: Protecting contents from moisture, dust, and leakage for powders, granules, or hazardous materials. Worker safety during packaging is a key concern.

Agriculture: Handling seeds, fertilizers, and specialty crops requiring moisture barriers or dust containment.

* E-commerce Fulfillment: Securing individual items within master cartons during the picking and packing process for added protection during transit.

The application consistently centers on adding a protective layer, preserving product integrity, meeting regulatory mandates, or enhancing presentation, all while replacing manual, labor-intensive tasks.

1.2 Unveiling the Technology and Automation Advantages

Modern Bag Inserting Machines integrate sophisticated mechanisms:

1. Bag Separation & Feeding: Systems reliably separate individual bags from a stack (magazine) and feed them into the opening mechanism. Vacuum suction cups are commonly employed.

2. Bag Opening: Precision actuators, often utilizing controlled air jets or mechanical fingers, open the bag mouth. Sensors confirm successful opening before proceeding.

3. Bag Placement & Holding: Robotic arms or servo-driven grippers transfer the opened bag into the waiting carton, positioning it accurately. Clamps or gentle suction may hold the bag open at the carton’s top.

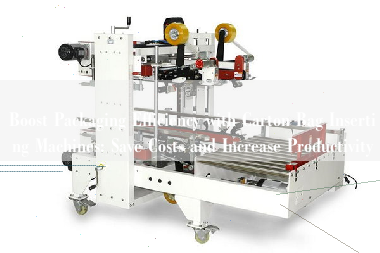

4. Integration & Control: Machines synchronize seamlessly with upstream Case Erectors and downstream Case Packers or Case Sealers via Programmable Logic Controllers (PLCs). Sensors monitor each step for fault detection.

The automation delivers compelling operational advantages:

Labor Cost Reduction: Significant decrease in manual labor required for bag handling and insertion.

Increased Throughput: Machines operate at consistent, high speeds far exceeding manual capabilities.

Enhanced Consistency & Quality: Precise, repeatable bag placement eliminates human error, ensuring every carton is prepared correctly.

Improved Hygiene & Safety: Minimized human contact reduces contamination risks in sensitive industries and enhances operator safety around potentially hazardous products.

Reduced Product Waste: Accurate handling minimizes bag damage and misplacement.

Optimized Line Speed: Synchronization with upstream and downstream equipment prevents bottlenecks, maximizing overall packaging line efficiency.

* Scalability: Automated systems readily adapt to increased production volumes without proportional labor increases.

The adoption of Bag Inserting Machine technology signifies a strategic move towards leaner, more reliable, and cost-effective packaging operations, solidifying its position as a core driver in the ongoing industrial efficiency revolution. Yanmao Intelligent Equipment (Suzhou) designs robust Bag Inserting Machines integral to achieving these productivity gains.

2. Price Perspective: Bag Inserting Machine Cost Analysis and Purchase Strategy

Understanding the operational value of Bag Inserting Machines necessitates a thorough examination of investment considerations. Strategic procurement balances upfront costs against long-term productivity gains across diverse packaging environments.

2.1 Deep Analysis of Key Price Influencing Factors

Machine pricing reflects engineering complexity and operational capabilities. Core determinants include:

Automation Level and Throughput

Fully automated systems with robotic integration command higher investment than semi-automated units. Machines exceeding 25 bags per minute require precision servo-drives and advanced PLCs, increasing component costs. High-speed models targeting pharmaceutical or food production often incorporate stainless-steel construction for sanitary compliance, adding 15-25% to baseline pricing.

Bag Handling Versatility

Machines processing multiple bag types – Poly Bags, Woven Poly Bags, or laminated pouches – integrate adaptable gripping systems and sensor arrays. Units accommodating bag size ranges beyond 20″x30″ require reinforced frames and wider conveyors. Specialty applications like static-sensitive bags necessitate anti-static components, impacting final quotes.

Integration Complexity

Pricing escalates with connectivity demands. Machines synchronizing directly with upstream Case Erectors and downstream Robotic Palletizers need proprietary communication protocols and custom mounting interfaces. Facilities with legacy equipment often incur retrofit engineering expenses. Plug-and-play designs for modular lines reduce integration costs by 10-18%.

Durability and Compliance

Industrial-grade models with IP65-rated electronics and hardened alloy frames withstand harsh environments like frozen food facilities. Certifications for ISO 9001, CE, or UL safety standards involve rigorous testing and documentation, contributing to manufacturing overhead. Machines lacking regional certifications risk non-compliance penalties.

Service and Lifespan

Global suppliers with North American/European service centers include regional support infrastructure in pricing. Machines with <12-hour response guarantees typically feature remote diagnostics and on-site technician networks. Extended lifecycle models (10+ years) utilize premium bearings and motors, reducing total cost per bag over time.

2.2 Market Trend and Budget Optimization Guide

Current market dynamics show a 14% annual growth in automation adoption, with chemical and e-commerce sectors driving demand. Supply chain disruptions have increased lead times for semiconductor-dependent components by 30-45 days since 2022. Budget planning should incorporate these realities:

Strategic Procurement Approaches

– Total Cost Analysis: Calculate ROI using metrics like labor reduction (1 machine ≈ 3-5 FTEs), waste minimization (up to 7% material savings), and throughput gains (20-50% line speed increases).

– Phased Implementation: Deploy machines in high-volume SKU lines first, scaling to secondary lines after ROI realization. Semi-automatic models serve viable entry points for facilities under 100 cartons/minute.

– Lifecycle Partnerships: Negotiate maintenance contracts bundling preventive services, spare parts discounts, and software updates. Reputable suppliers offer 5-year performance guarantees.

– Financing Models: Leverage operating leases preserving capital reserves. Tax-advantaged equipment financing in the EU/US can reduce net costs by 8-12% through depreciation benefits.

Market-Specific Guidance

European manufacturers prioritize energy efficiency certifications like ISO 50001, favoring machines with regenerative drives. North American buyers emphasize OSHA-compliant safety guarding and local technical support. Budget allocations should reserve 15-20% for installation, training, and contingency adjustments.

Project timelines benefit from early vendor consultations defining exact bag specifications, footprint constraints, and future scalability needs. Yanmao Intelligent Equipment provides customized ROI simulations aligning machine specifications with operational targets.

3. Brand Dynamics: Top Bag Inserting Machine Brands and Selection Guide

Navigating the competitive landscape of bag inserting machines requires evaluating technological excellence and operational reliability. Leading manufacturers differentiate through engineering innovation, material adaptability, and global service networks.

3.1 Global Leading Brand Strength Comparison

Industrial automation leaders demonstrate distinct capabilities across core performance metrics:

Technology Specialization

European manufacturers excel in pharmaceutical-grade systems featuring hygienic stainless-steel construction and ISO Class 8 cleanroom compliance. North American brands dominate heavy-duty applications with ruggedized designs handling drums up to 55-gallon capacity. Yanmao Intelligent Equipment bridges these segments with modular architectures adaptable to cartons, poly bags, and drum liners across temperature extremes (-20°C to 50°C).

Throughput and Precision

Top-tier brands achieve 30-45 bags/minute with ±0.5mm positioning accuracy. High-speed models incorporate machine vision for orientation verification and anti-static systems for electronic components. Yanmao’s robotic insertion systems maintain <0.1% misfeed rates even with irregularly shaped poly bags through adaptive suction grippers.

Integration Capabilities

Market leaders offer proprietary communication protocols (EtherCAT, PROFINET) enabling plug-and-play connectivity with case erectors and robotic palletizers. Yanmao’s integrated systems reduce line footprint by 40% through unified controls managing bag insertion, case packing, and sealing sequences within single HMI interfaces.

Global Support Infrastructure

Manufacturers with regional technical centers provide critical advantages. Yanmao maintains ISO-certified service hubs in Germany and Illinois, delivering <24-hour response times with multilingual support. Competitors without localized spare parts inventories risk 2-3 week downtime for component replacements.

3.2 Consumer Insights and Efficient Selection Techniques

Operational feedback from food processing and chemical facilities reveals consistent evaluation priorities:

Performance Validation Methods

– Request throughput validation reports using actual product samples (not test media)

– Verify mean time between failures (MTBF) exceeding 4,000 operational hours

– Analyze energy consumption data against ISO 50001 benchmarks

– Review third-party validation of noise levels below 75 dB(A) in production environments

Warranty and Lifecycle Value

Leading manufacturers offer 3-5 year comprehensive warranties covering both mechanical and control systems. Yanmao’s performance guarantees include free remote diagnostics and preventive maintenance scheduling. Evaluate total cost of ownership using metrics like cost-per-insertion, calculating energy use, consumables, and expected service intervals over a 10-year lifespan.

Compatibility Assessment Framework

1. Material Testing: Submit sample bags/pouches for free machine trials

2. Line Simulation: Validate synchronization with existing case sealers or palletizers

3. Scalability Audit: Confirm capacity headroom for future production increases

4. Compliance Check: Ensure regional certifications (CE, UL, CRN) match facility requirements

Pharmaceutical manufacturers prioritize suppliers with audit-ready documentation for FDA 21 CFR Part 11 compliance. E-commerce operations emphasize rapid changeover capabilities for multi-SKU environments. Yanmao’s configurable presets enable <5 minute format transitions between carton sizes and bag types.

Industry benchmarks show facilities reducing manual labor by 72% after implementing Yanmao’s automated bag insertion systems, with ROI periods averaging 14 months in high-volume operations. Operational data from installed systems demonstrates 99.2% uptime in continuous production environments.